In addition to the cost of living alone, the sandwich generation must also bear the financial burden of parents, these are 6 tips from the experts

Illustration

Illustration

News24xx.com - The generation that must bear the needs of parents and simultaneously must meet the needs of their spouses and children, is called the sandwich generation.

This overlapping and squeezed responsibility is likened to a sandwich that contains various components in it.

Meeting the needs of parents and family is not an easy matter for the sandwich generation, especially if you have limited income.

To that end, Wolipop talked with financial planners, Bareyn Mochaddin, S.Sy., M.H., RPP to share tips for the sandwich generation who must bear the financial burden of their own families and their parents or younger siblings.

1. Manage income and expenses

According to Bareyn, for the sandwich generation, you have to know how much income and expenditure each month.

Read more: Erick Thohir announced the new stimulus package which will inject a financial boost to employees of private companies

"Expenditures are not only our families but also expenses from people we provide assistance for example our parents. In this way we can see whether the expenditure is really needed or not. If the expenditure is not needed, then it can be reduced or eliminated so that the financial burden on us is not too heavy, "said Bareyn to Wolipop on Thursday (23 July 2020).

2. Look for other income

For the generation of sandwiches whose finances are limited, they can add to income other than salary. For example, now your place of residence is different from your parents, but it turns out that the parent's house is quite large, if possible, you can move to your parents' house and live with them. And your own house can be rented or vice versa.

In addition, said Bareyn, you need to know what assets are owned. For example, even though parents do not work but have a house, land, and so forth. The asset must be optimized, for example by leasing it so that it can generate income to meet household needs everyday. You can also save the tube too!

3. Change the form of help

The next tip is to change the form of help. If you are limited to helping with money, you can replace it through food or other things.

4. Prepare health insurance

For the sandwich generation to pay for their parents, one of the other important needs is related to health. Like seeing a doctor, blood check, or other. So Bareyn suggests having health insurance for parents.

Read more: Severe! Because of Corona, OPEC Oil Organization is Threatened to be Disbanded

5. Prepare an emergency fund

Bareyn suggested setting up more emergency funds for the sandwich generation to finance more than one family.

"So prepare an emergency fund to guard when a risk befalls one family. Prepare an emergency fund 9 to 12 times monthly expenses. Just collect slowly," he said.

6. Prepare funds for future generations

For sandwich generations, of course, they have learned from their life experiences that they have to pay for their own parents and family. Therefore, prepare carefully so that it does not happen again in the next generation.

"For those of us who are included in the sandwich generation group, we must know the discomfort of being squeezed and have to finance two families and even more. So, prepare well financially so that this does not happen again in the future," concluded Bareyn.

-

Aug 07, 2020 | 05:06 pm LT

Aug 07, 2020 | 05:06 pm LTErick Thohir announced the new stimulus package wh...

-

Aug 05, 2020 | 11:48 am LT

Severe! Because of Corona, OPEC Oil Organization i...

-

Jul 31, 2020 | 10:04 pm LT

Jul 31, 2020 | 10:04 pm LTFrance's economy has contracted by a record 13.8 p...

-

Jul 29, 2020 | 01:47 am LT

Jul 29, 2020 | 01:47 am LTThe Ministry of Finance explained the amendments o...

-

Jul 28, 2020 | 04:07 pm LT

Jul 28, 2020 | 04:07 pm LTIndonesia’s tourism industry to hinge on Bali’...

-

Jul 26, 2020 | 08:35 am LT

Jul 26, 2020 | 08:35 am LTA migrant laborer in India sold off his 15-day-ol...

-

Aug 16, 2020 | 05:06 am LT

Aug 16, 2020 | 05:06 am LTAttack of Racism; Give Salute in the style of Nazi...

-

Aug 09, 2020 | 11:50 am LT

Aug 09, 2020 | 11:50 am LTViral Story of an old woman in Indramayu who almos...

-

Aug 09, 2020 | 10:55 am LT

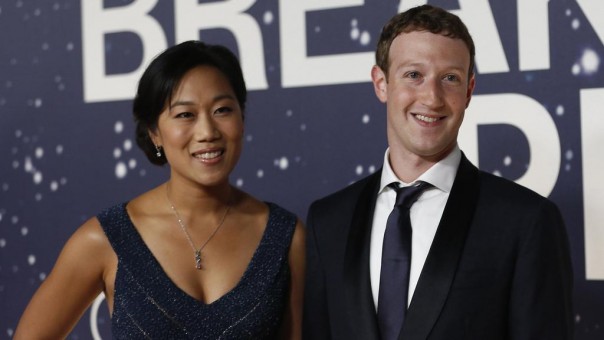

Aug 09, 2020 | 10:55 am LTMark Zuckerberg has joined the world's most exclus...

-

Aug 09, 2020 | 10:45 am LT

Aug 09, 2020 | 10:45 am LTRevealed! It turns out that this is the origin of ...

-

Aug 09, 2020 | 10:42 am LT

Aug 09, 2020 | 10:42 am LTSevere! A Woman in South Tangerang is Raped After ...

-

Aug 09, 2020 | 09:34 am LT

Aug 09, 2020 | 09:34 am LTDor! This Man's Intestine Explodes After Eating A ...